Stock of the Day

- Started

- Last post

- 679 Responses

- DaveO5

Responding to @_niko – i don't think we need to become hedge fund managers but what I have realised in recent years is that we need to teach our kids to invest, get familiar with the markets and do it EARLY. I've only just started paying attention to it and MY GOD i wish someone had sat me down in my 20s and told me what to do. Obviously technology and retail investing is way more accessible now, but still....

Even just a few investments in passive index funds can earn money on the daily in a strong market, and i'm damn's sure I'll be having the conversation with my boys when they're old enough.

So I don't think the artist, the craftsman, the farmer, the soldier need to turn into day traders YOLOing stimmy checks into meme stonks for tendies, but I do think that a bit of literacy will take you a long way. Hoping so for my kids anyway!

- Don't regret, dude. Many people sat me down in my 20s and told me exactly what to do and I didn't because I was in my 20s. Young dudes think they know everythin********

- I'm glad someone told me! Intro'd me to vanguard last year and I started in some ETFs with an inheritance check – not much but off to the races!DaveO

- Yeah there's that stuff but in my early 20s I was barely surviving, living on credit, was relatively poor. Saving was out of the question. Low wages are tough.********

- I've been buying small steady shares on behalf of my kids since their birth. National Grid, HSBC and Rothchild funds. Compound interest is the true force.Hayzilla

- My dad has always been a 'day trader' and did the same for me but I couldn't give a fuck until in my 30's.Hayzilla

- Agree Dave0 I had a talk with my kids recently, I started investing again this year more seriously after a decade or so off, but I told them It might be too_niko

- late for me but what little investing I'm doing now will be all theirs one day, I said imagine if your grandfather had bought apple in the 80's even 1k worth_niko

- I'm going to let them research a company and buy a few shares for them and let them follow it. They've already realised investing in sneakers is a waste lol_niko

- You guys are totally right, I can't be grateful enough to my dad for starting me with investments in my teens. To me it makes working that much more enjoyablezarkonite

- because retirement money mostly comes from other sources so I've been able to really focus on doing what I want regardless of pay.zarkonite

- I had fuck all when I was in my early 20s too BUT when i did start to save money I can imagine I'd have been thrilled that it was working for ME.DaveO

- TBH, It was unapproachable for me until robinhood came out. Trading stocks always came with fees and brokers and shit only grown ups in suits can understandscarabin

- Don't regret, dude. Many people sat me down in my 20s and told me exactly what to do and I didn't because I was in my 20s. Young dudes think they know everythin

- NBQ00-2

Another day where GME is being halted like every minute. Sigh. So annoying and their stupid circuit breakers.

- learn that shit:

https://personal.van…sted - https://www.warriort…

this is better because it mentions what GME had for 5 mins this morning: Volatility Pausested

- learn that shit:

- sted5

Keith Gill Drove the GameStop Reddit Mania. He Talked to the Journal.

- add a dot between the .com and the /articles to bypass the pwsted

- Hack of the day sted.eryx

- this also works on the bloomberg network sitessted

- ^ that shit don't work, son. i have a subscription tho.sarahfailin

- lol that's fab.********

- @sarahfailin it doesn't works because ye a kant with a .edu account :D:D

i will let u know when they close this backdoor :)sted - American Ninja?GuyFawkes

- @GuyFawkes Hachimaki is a military symbol :)sted

- *samurai military...sted

- Save some pu**y for the rest of us Keith!ideaist

- nope, doesn't work unfort.fadein11

- http://hkmdb.com/db/…GuyFawkes

- Worked over here... sweet.hosscreative

- ahaha wtf i'm still stuck at dis: https://www.gstatic.…sted

- sted you haxorrenderedred

- . didn't work for me********

- try harrdrrrrsted

- any nerdy explanation on why this . hack works?uan

- didn't work, then tried shift+refresh and it works for me. Nice tip!

Explanation: maybe something for SEO?monNom

- _niko4

as much as I love the explanation by that car girl on how it works, when it comes to shorting stocks there's one thing I still don't get.

You "borrow" 100 stocks at $10, you sell them right away and make $1000. Then the stock drops to $7 and you buy 100 shares back costing you $700 so you give those 100 shares back giving you a proft of $300.

So the mechanism for "borrowing" is unclear to me. Who are you borrowing from? Are they approaching other firms that hold the stock?

or are is this more like "Owning Mahoney" where they play with the peoples money in the safe, taking it to the casino and returning it in the morning?- writing this I think it's got to be selling the shares they're already holding for clients._niko

- You're selling a contract which describes the arrangement you just mentioned, for a fee. The shares only move when the contract expires.zarkonite

- The short sellers on GME are "holding" by buying new contracts when their old ones expire, but the new contracts are increasingly more expensive b/c of reddit.zarkonite

- Eventually they'll run out of capital to buy new contracts (or just feel like enough is enough) and take the loss.zarkonite

- The short sellers are panicking because this was supposed to be a small job, but it's turned into a multi-billion dollar bet. Thank you internet mob!zarkonite

- you borrow from your exchange. until recently, most individual investors didn't have access to those kinds of trades. RH and others changed that.sarahfailin

- what's the time frame like and who calls it? can't they say I'll buy the new contracts when the price comes back down? what are the consequences of not coverin_niko

- talk to me like I'm Ralph Wiggum :)_niko

- Read this up, it's a good summary: https://www.thebalan…zarkonite

- it's a bet. just like racing. you don't own the horsetrooperbill

- Im thinking you shouldn’t be able sell something you do not own in the first place. Is it a error/gap In the system...islandbridge

- ...And If that’s the case, could this be fixed with blockchain technology?islandbridge

- @zarkonite thank you for having

the patience to describe this :)sted

- palimpsest1

- if you look at the chart, a lot of those dudes profited huge, just as many lost a fuckload, and some bought more on the dip yesterday ... HODL my ass :)monospaced

- This unicorn idea that everyone would buy and hold is so naive. Of COURSE the poitn was to to get it up and then sell off for the moneeeez. That's the market.monospaced

- We each pray to our own gods.palimpsest

- rule #1 of internet trade chat is to say you're doing xyz, tell everyone else to do xyz, and then do frowatm.shapesalad

- frowatm= fuck right off with all the money.shapesalad

- zarkonite4

They shouldn't allow short selling, if you want to bet against a company you should invest in its competitors. At least this way it's tied to reality and not this magic math trading bullshit.

- Gregory from the walking dead was the personification of this. A swindler, grifter, was smarter than everyone else, didn't have to do any work or contribute_niko

- look how he ended up lol https://www.thesun.c…_niko

- short selling = borrowing and selling shares, with the aim to buy them back cheaper and return to lender, keeping difference.shapesalad

- short selling is a really useful tool. Ideally you use it to hedge in the first few mins/hours of a trade, just in case the market goes against you.shapesalad

- Selling something you don't own is ridiculous in any other circumstances.zarkonite

- then you can close your long trade at a loss, but make it back with your short. If your long is all good, you close short and put a stop loss in above your buy.shapesalad

- and the trades on stocks should reflect what's happening with the company in the real world, this is just a taking capital away from creating jobs.zarkonite

- It's a parallel economy that only deals in cash to make more cash.zarkonite

- I get how it works Shape, I've been doing it a long time. I just don't think it's good for society or the economy at large. The idea of buying stock was to helpzarkonite

- companies access capital to expand and create more jobs. This is totally not that.zarkonite

- @zarkonite +100Krassy

- @zarkonite +1000sted

- sted3

Difference between these entities(hedgies and retails) is that one is disciplined acts in a goal-oriented manner, while the other needs to be pointed into a direction and constantly reminded of what to do and why. This is not sustainable in the long run.

- Yeah hedges really need to set goals and be more disciplined.shapesalad

- You do know that 80%+ of hedge funds fail within 5 years?shapesalad

- aghaha yeah those lazy fuckers have to pull themselves together :D

no i didn't knew.sted

- NBQ000

We may, just may have the stock market being toppy and entering a correction. Maybe I‘m wrong but we are in a big bubble everywhere. Too many people have too much money to play with and now there‘s gonna be tears.

- And it's going to be us normies who suffer. Again.Continuity

- https://www.youtube.…shapesalad

- SteveJobs2

- YT comments:

"He’s lying. Even his eyebrows are trying to run off his face."

"How his pants haven’t caught fire is a miracle."imbecile - what i can't understand that they have a powerful user base, and yet they bend the knee for uncle melvinsted

- What if uncle melvin has something else to offer? like legislation influence, bending the rules for their favor?sted

- even if its a lie i found that far more powerful influence factor than the short term profits.sted

- Vlad's a billionnaire; he's not after the $; sted is right - powerful influence factors are at playKrassy

- It's called Capitalism!utopian

- He kept repeating marketing talking points instead of answering the question. Good move, vlad.cherub

- It‘s not just Robinhood, I noticed this kind of shit happening in many other brokers during crucial times. Either you couldn‘t login or there was an outage or..NBQ00

- ..they restricted the trading. Always happened during very crucial times when you had to react quickly. The casino really makes it hard for you to win.NBQ00

- YT comments:

- grafician-6

- too late?Krassy

- Imagine trying to IPO after this fiasco...grafician

- IG over in UK not allowing purchasing of GME. Since when does a broker tell you what you can and can't buy!?shapesalad

- when they are f***ing scared.monNom

- scarabin11

- dkoblesky0

This is a little behind...since the Robin Hood stuff didn't happen yet but for once I am all in with what Glenn Greenwald is saying here

bottom line: to break the grip of the oligarchy that runs the US, left and right need to find common ground and he is clearly excited that this could be a strong example of that

- What percentage of WS is NOT gambling? Let's also not forget that hedge funds, on average, have beat the market by a measly 1.5% over the past 20 years.formed

- Hardly successfully "rigging" the system. They get rich by charging their client's ridiculous amounts.formed

- Let's not forget that the Right wants total de-regulation (let WS gamble however they want, regardless of consequence).formed

- and the Left wants more regulation and ensure these WS institutions can't create another 2008.formed

- For my naive view, it scares me how easily the entire market/world can be manipulated via social media. In this case, it seemed "good", but the next?formed

- Everyone always has an agenda, as Greenwald points out.formed

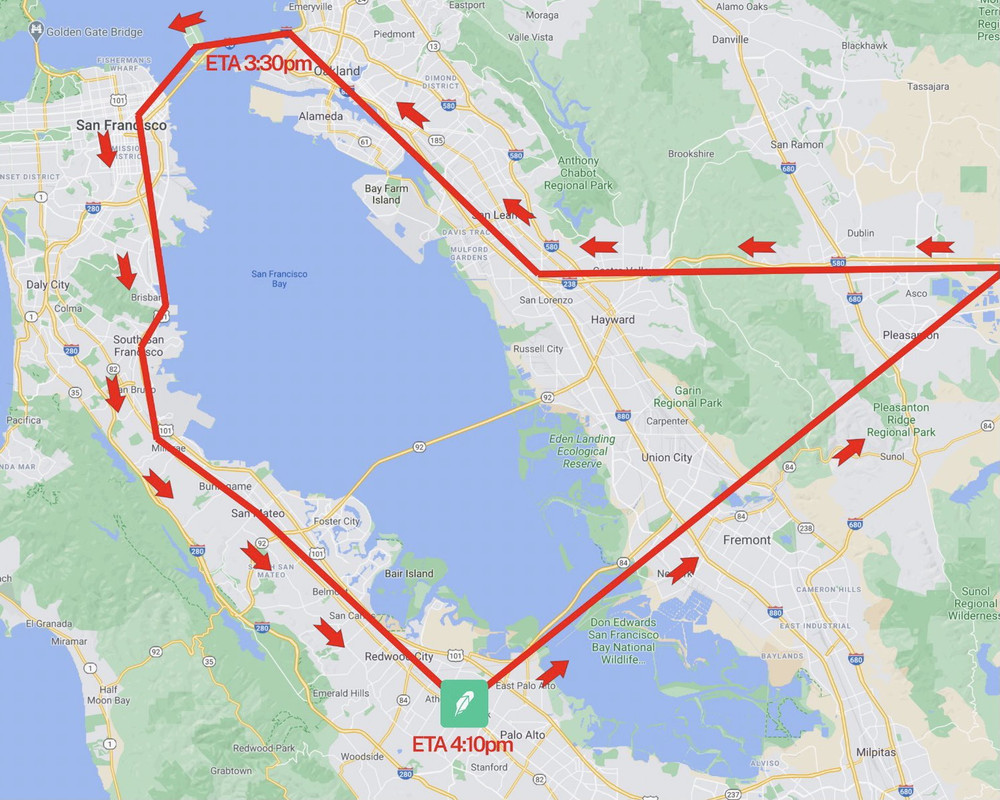

- ESKEMA7

LOL

——

It's happening. At 3-4:30pm PST a plane will be flying a banner over San Francisco that says

"SUCK MY NUTS ROBINHOOD"

and I slid the pilot some extra $$ to circle right above RobinHood's HQ for a while. Go take some photos, I don't even live there Face with tears of joy

Here’s the flight path:

- utopian0

Silver Lake cashes out on AMC for $713 million after Reddit-fueled rally.

Buyout firm Silver Lake disclosed on Friday that it sold its stake in AMC Entertainment Holdings for $713 million this week, capitalizing on a 10-fold rise in the price of the shares as traders organizing on social media platforms such as Reddit snapped them up.

HAHHA...fuck you Hedge fund vampires.

- Haha. SweetGnash

- Yeah. And fuck another million amateur investors who saw their piece of this evaporate as a result, too! So awesome really cool way to show them!monospaced

- At least at a hedge fund they pay each other and their clients.monospaced

- I am confused, which billionaires are we against now?formed

- kellogg2

A normal Brogan explains what's happening on the stock market

- uan0

'we can be retarded longer than you can be solvent'

- what am i listening to hear? hyped up presenters? content = ?shapesalad

- just came across this on twitter, nothing new, just a guy who is inside that world who explains how it went down.uan

- shapesalad-1

Here's some better content regarding recent GME stuff if you want to recap:

- Jim Bianco's analysis is on point.shapesalad

- I get the impression that Jim Bianco commentary is of real value in how markets work. tnx.

In an ideal world, we would get UBI and invest in enterprises thatuan - solve real problems for everybody.uan