Stock of the Day

- Started

- Last post

- 679 Responses

- doggydoggdog-1

I Bonds

- grafician-2

"US economy contracted 0.9% in second quarter, govt data shows, deepening recession fears - AFP"

Here we go

- yesterday's news!sarahfailin

- They're trying to change the definition of the word so they don't acknowledged it already started...grafician

- Anyway get your cash ready to buy soon

Not the bottom yet, but soongrafician - lol, “we,” you don’t live heremonospaced

- lol uhm...we can still access the markets you know?grafician

- @mono and your old argument "you don't live here, it shouldn't concern you" clearly shows how little you know about how the world actually worksgrafician

- I know as much about how the world works as anyone, but of course you have to be a condescending insulting cunt.monospaced

- I know it doesn’t affect you the way it as it does “us,” because you aren’t even close to one of us. You are on the periphery.monospaced

- That’s a good thing.monospaced

- Enjoy your well deserved, rightly earned downvotes. Maybe you will get a clue one day, but I have doubts.monospaced

- And you always have to comment on my posts to start a fight?grafician

- Do you even have anything to add on the actual fucking topic of this post?grafician

- Yes. This affects me more than some kid in Romania. Because I’m a citizen.monospaced

- @monospaced your replies lately are the definition of *cringe*grafician

- Only to you little buddy. What’s cringe is how you have absolutely no self awareness, despite the consistent negative responses you receive.monospaced

- If anyone calls you out, you blame them like a clueless little nitwit, who still thinks he is superior when all he does is copy paste late newsmonospaced

- that doesn’t concern him. Acting like you’re some world savvy investor when you really are just a young alone entry level app button “designer”monospaced

- STOP with the cringe booth boy!grafician

- sarahfailin0

It's disingenuous for anyone to say we're not headed towards a recession. We may already be *in* one. Here are 3 strong indicators:

1. The bond yield curve is the most inverted it's been since before the Great Recession, and this phenomenon has preceded every recession for the last 100 years. The yields between the 3 MONTH bond (2.38% today) and the 10 YEAR bond (2.63%) are rapidly approaching each other, which is even scarier. ((Longer term bonds should pay more than short term ones for those who don't know.)) Track the yield curve here: https://fred.stlouisfed.org/seri…

2. There was a major oil price spike! This may be more of a correlation than causation thing, but higher cost of energy makes everything else cost more too.

3. Receding GDP. We had reductions in GDP the last two quarters, which isn't surprising given how fiery hot the economy has been. What goes up must come down.

- grafician-3

"House Democrats plan to announce a proposal next month to ban lawmakers, their spouses and senior staff from trading stocks, according to multiple sources close to the issue."

Here we go

- “We?”monospaced

- @monospaced here you go: https://www.merriam-…grafician

- Krassy2

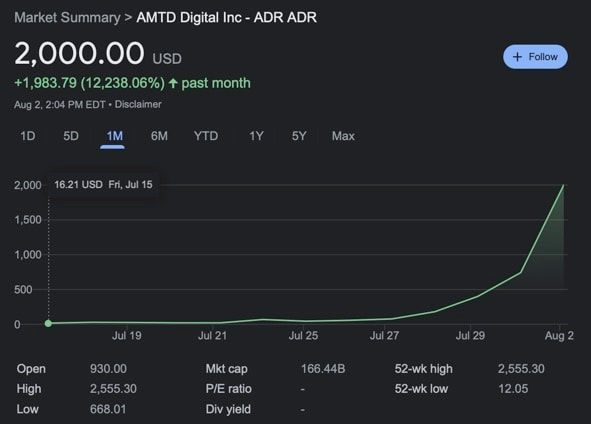

ATMD Digital: Why Did the Stock Suddenly Skyrocket?

Two weeks after its IPO, AMTD Digital's stock has gone from $7.80 to $2,000.- hodl that shit!hans_glib

- Who is buying? And is it a very low-float stock to justify such a quick rise?NBQ00

- why didn't we find out about this mid-j

uly?_niko - Based in Hong Kong?

lol byegrafician - cue FOMO and it reaching 4000usdshapesalad

- :'(instrmntl

- Anyone shorting this with leverage from here on in are going to be very, very happy people.Continuity

- grafician0

"This Tiny Firm Just Surpassed Goldman Sachs With a 14,000% Gain

Convoluted ownership structure behind AMTD Digital points to Calvin Choi, an ex-UBS banker who’s fighting an industry ban in Hong Kong."

https://www.bloomberg.com/news/a…

"The world, apparently, has a new financial giant.

AMTD Digital Inc., a Hong Kong-based company that listed in New York less than three weeks ago, has surged so much that the combined market value of its Class A and Class B shares was more than $203 billion as of Wednesday’s close.

That means the firm — which develops digital businesses, including financial services — is worth more than Wells Fargo & Co., Morgan Stanley and Goldman Sachs Group Inc., despite reporting just $25 million in revenue for the year ended April 2021."

- grafician-1

"'Big Short' investor Michael Burry sold all but one of his stocks last quarter — after warning an epic market crash is coming"

"Michael Burry of "The Big Short" sold virtually all of his US stocks last quarter.

Burry's Scion Asset Management held only a $3.3 million stake in Geo Group, a new filing shows.

Scion owned $165 million of stocks at the end of March, excluding its Apple put options."

- shapesalad0

Interesting backstory about the Porsche IPO:

- shapesalad0

Queen Elizabeth Crypto-Coins:

- grafician-1

Credit Suisse crashing, act accordingly...

- ********1

I’m reading a lot of SP500 doomsday predictions. People are like “oh my god the market is crashing what will we do”

But, the SP500 is up from 2 years ago (oct 2020, which was after the Covid “crash”) It’s also up from 5 years ago, and ten years ago, even factoring in inflation. Take most points in history and the SP500 is still doing well. Of course, that’s no guarantee it won’t go down.

My point is that perspective is everything. Don’t listen to the shouting, look at the numbers.

- "Past performance is not indicative of future results"grafician

- ********0

Ok so I’ve saved up a bunch of cash, earning a very low 2.5% per year in a savings account. I’ve been waiting to buy into a low cost SP500 ETF. I know it’s bad to think one can “time” the market, but on the other hand there are lots of doomsayers saying doom is nigh. They say the market will continue to go down

On the other hand, isn’t my money being devalued by inflation? So, doesn’t it make sense to buy stock now? Even if it goes down, it’s going to go down if I keep it as cash, too

- Just buy Tesla stock. Why dilute. Look at their robot - in 5 years time it will be a game changer. Tesla = factory technology, that's their moat and USPshapesalad

- Compare boston dynamics to Tesla bot. Once is cost effective, can be made in the millions and has AI. The other is made in a small number, is pre programmed noshapesalad

- AI and very costly. Yes one looks advanced and can do parkour, but we don't need that. We need something to do boring jobs in factories 24/7/365shapesalad

- The amount it’s going down as cash value is not very significant. If you can afford to not have it as spending money you can consider investingmonospaced

- But a 2.5% year savings interest rate is really really really good for a savings account.monospaced

- I wish I knew the right thing to invest in right now. I bet a mid level UI designer in Eastern Europe might have the best advice. Lol.monospaced

- I'm actually Lead UX/UI and I recommend staing in cashgrafician

- With the uncertainty of the global market, you should probably stick with the 2.5% interest rates of your savings account.utopian

- That is pretty amazing for a savings account! Where do you get that?

Wait a few months then DCA into VOO. Set some GTC orders and be done.formed - 2.5% is from SoFi. There’s no limit to size of the account which is amazing. You need direct deposit but it can be a tiny amount, even $1 if you want.********

- https://www.sofi.com…

2.50% APY******** - Stick 30% into the s&p 500 and do it again in 6 months - keep the rest in cashSlashPeckham

- grafician-4

"Bulls: After all that, S&P 500 is still only 20% off its high.

Bears: After all that, S&P 500 is still only 20% off its high."

"S&P 500 Growth by Decade:

+259% (2010-2019)

-9% (2000-2009)

+433% (1990-1999)

+407% (1980-1989)

+77% (1970-1979)

+112% (1960-1969)

+482% (1950-1959)Long term investing makes the most sense for most people.

Low cost index funds are the best choice for the average person."aaaaaand recently on Wednesday:

"One giant options transaction may have set off the S&P 500’s bounce today, according to Wells Fargo"

- grafician-2

"I don't think people really appreciate what's happening in the options market right now.

Last week, retail traders bought $19.9 billion worth of puts to open. They bought only $6.5 billion in calls to open.

This is the first time in history that puts were 3x calls."

- Retail traders also buy far far out of the money with puts. It's pretty much lottery tickets.shapesalad

- S&P under 3K high probabilitygrafician

- grafician-2

"Netflix adds 2.41 million subscribers, beating market expectations, as shares rise by 14%"

- Nearly 4 million people left Russia in early 2022... coincidence?********

- yes that's their priority after leaving russiapango

- Who said priority? It takes 5 minutes and they had many, many weeks to do it********

- Yes and there are so many streaming services + pirate. You so sure 2.4 million subscribed to Netflix?pango

- Nearly 4 million people left Russia in early 2022... coincidence?

- grafician-2

$SNAP -25%

- oh..._niko

- increase of users was probably bots..dropped more then Q1 report and eps was way worse********

- snap is falling out of relevancy at lightspeed.********

- It's second in the US after tiktok for teens

All social media if they drop bots the real numbers would be scarygrafician - But advertising budgets being cut, all social media will suffer including Meta, Alphabet etc.grafician

- Alphabet still does fairly well (it's not social ads)formed

- good old recession that we aren't in (according to some) is really ruining the fun********

- I thought Snapchat died, like, years ago.Continuity

- grafician-3

"Amazon's $AMZN market cap falls under $1 trillion for the first time since April 2020."