Stock of the Day

- Started

- Last post

- 679 Responses

- grafician-3

META -51%

AMZN -9%

AAPL +4%

NFLX -3%

GOOG -29%- I wouldn't buy more AAPL as they won't be able to pull out of China soon enough

Meta is doomed. AMZN only AWS is good, google's ads are in decline

nothing safegrafician - GOOG, AAPL and AMZN will be just fine and aren't going anywhere. META is doomed, NFLX is a coin toss.formed

- Bezos lost $12 Billi tho'grafician

- the whole market is going to be crashing down this year i feel********

- meta has been a shit show since it started********

- I wouldn't buy more AAPL as they won't be able to pull out of China soon enough

- grafician-3

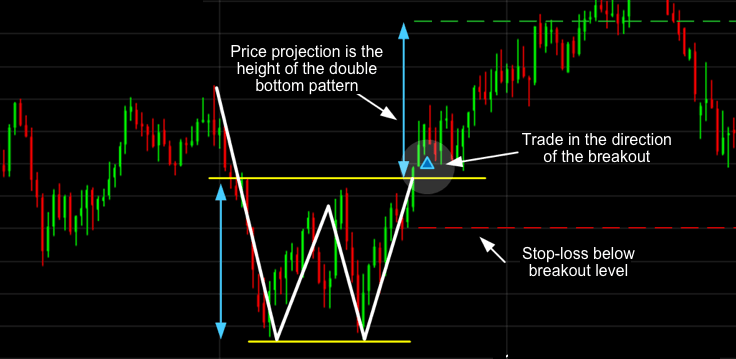

- This chart looks real********

- Everything runs on AWS, amazon oversold.shapesalad

- Probably the reverse was true last year.CyBrainX

- This chart looks real

- grafician-4

- explain this chart please.

you financial genius who can't even distinguish between two currenciessted - down from here... go to dollar.shapesalad

- lol wtf are you talking about sted?!grafician

- @shape yes, exactlygrafician

- questions again instead of answering the ones people are asking, bad habit.

https://www.qbn.com/…sted - Actually Adobe is known to change the currency but keep the prices, so you get $19 or 19 EUR here and £19 in the UK

But nice trygrafician - But as you're NOT a designer and you probably don't pay for Adobe CC, you didn't know

I'll let it slide...grafician - Also regarding this chart, just shows the S&P will go down with high probability

Now you can go fuck off :)grafician - I just renewed my private subscription, doesn't even allows region change since, cc address has to mach the region so you're fucked up in so many ways.sted

- Adobe is known for adjusting regional prices taking into account currency inflation, not to mention that we're talking about a negotiated price offering.sted

- So your experience with Adobe CC is minimal as expected. Why don't you stick to what you really know and leave others to their things?grafician

- Oh please graf. I bet you use less of Adobe cc and for less time than most people here.monospaced

- This was about trading not Adobe you muppeetgrafician

- And the S&P DID go down as predicted lolgrafician

- Predicted by everybody but you, who can't even explain its own post.The relation to the previous one - the Adobe subscription - is just how pathetic you are.sted

- explain this chart please.

- sted-1

- imbecile-1

PLL

- sted-1

https://www.toptal.com/finance/b…

Not just because of that, but all the other things too.

- sted-1

Kevin does some proper math on automotives :)

- grafician-2

"MARKETS: US stock markets lost $8.3 trillion in value in 2022"

- "The S&P 500 finished 2022 down -19.4% and the Nasdaq -33.1% for the WORST year since the 2008 financial crisis — $18 trillion evaporated"grafician

- thanks Obama!_niko

- It’s not that big of a deal. 2020 and 2021 were great.monospaced

- and it's not even saying that much. 2008 was the last downturn.CyBrainX

- doggydoggdog1

NPR was talking about biotech and companies are trying to get ahead of the next pandemic and MRNA is the future.

What companies are the best to invest in for Biotech? Seems like the move.

- I'm no longer human, my opinion is invalid.palimpsest

- that note :)))sted

- sted0

- sted0

GE

in 3-6 months.

acceptable price atm,

Happiness and instant buy is at ~90.I already have a modest 100x -> $128 -> 2023.10

PTN

BUY NOW.

- drgs-2

All bank stocks are halted, ponzi is up -- what is happening?

- Surprised nobody has been talking about it. Silicon Valley Bank failed last week. Over the weekend, signature bank was shut as well.monNom

- Now other small and midsized regional banks are getting sold as the reason suggested for Silicon Valley Banks failure is endemic.monNom

- That is, an accounting rule change allowed banks to hold some securities in a bucket marked “hold to maturity”. And some in a bucket “Mark to market”monNom

- The smaller mark to market bucket has been losing value as interest rates have been rising. The hold to maturity bucket was on the books at full value.monNom

- Even though it had actually lost value the same as Mark to market. SVB had enough losses between the two that they wiped out all of their equity and had to closmonNom

- As a result: Investors get 0. Insured depositors should get their money but may take a while. Govt backstopping uninsured depositors they say.monNom

- And it seems like SVB is just the tip of the iceberg. First Republic down 63% today suggests they will be next to go. It’s a contagion.monNom

- Lots of commentary over here if you want to follow along. Http://www.zerohedge…monNom

- It's called capitalism, Google it.utopian

- no one mentioned it here yet because trump isn't presidentGnash

- FED pivot this summer. Lock in a fixed rate interest saving account. Wait for cheaper mortgage rates.shapesalad

- So, the long and the short of it is: this is going to be 2008 all over again?Continuity

- What a relief, I thought we were only going to have war and climate change to entertain us in 2023. Let's have another Great Recession for the lulz.Continuity

- shapesalad0

https://twitter.com/notmrmanziel…

"Yesterday a Trader Bought $SIVB March 200 Puts for .25 Per Contract

They Spent $7,500 on the Position

Silicon Valley Bank is Down -60% Today

Position is now worth $2.1 Million"

- But the value is 106.04 USD?doggydoggdog

- Yes? About 50% down below his strikeNBQ00

- doggydoggdog1

Put a lot of my savings in VOO?

- grafician-6

"Bloomberg reports that ChatGPT can now predict stock moves from the headlines of articles."

lol okay

- grafician-9

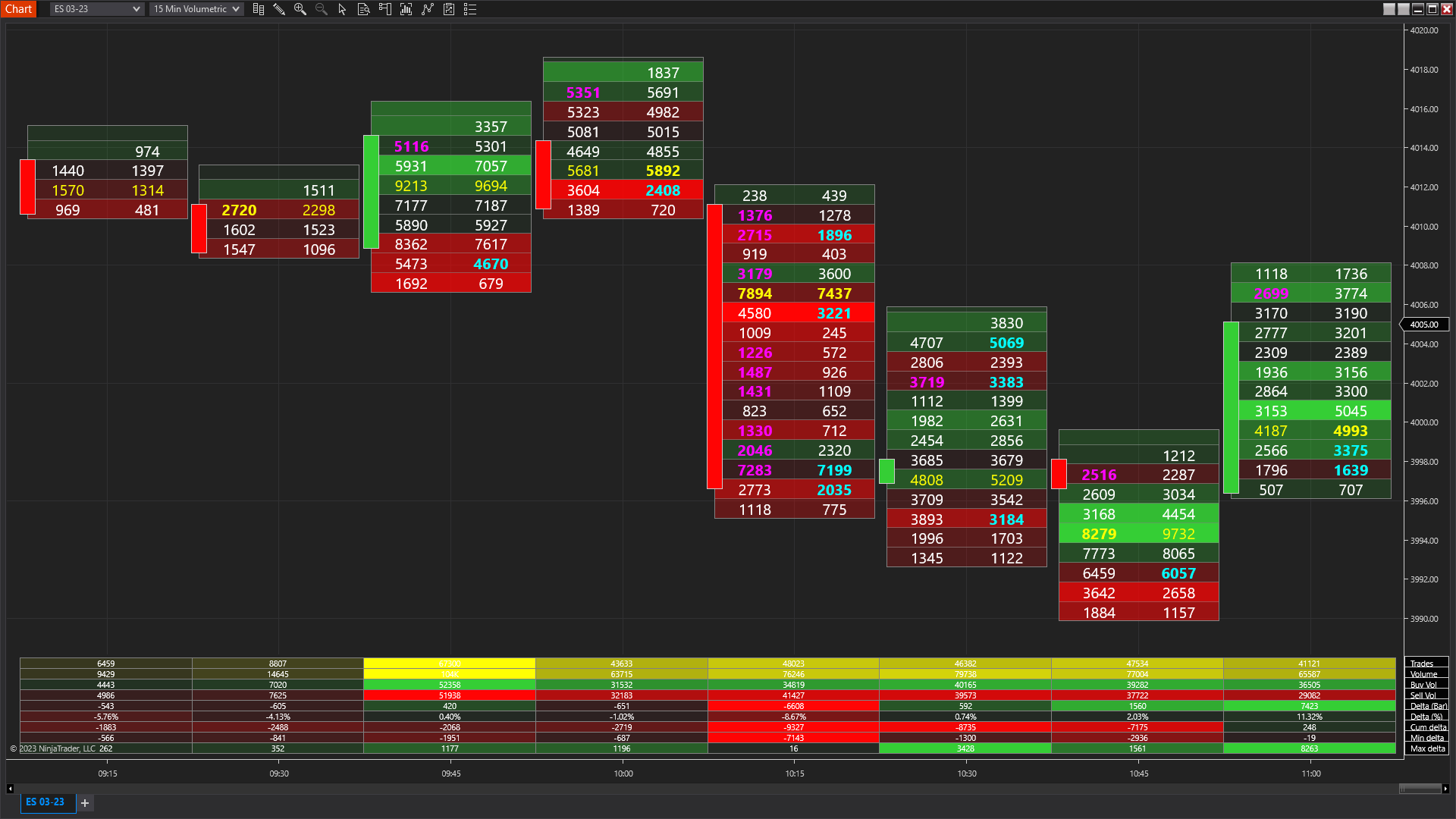

I've seen QBN users trading using Trading view

Can you try things like order flow?