Stock of the Day

- Started

- Last post

- 679 Responses

- sted1

Oil: BP, Exxon, and Shell all have significant investments in Russia that could be threatened by sanctions on Russia’s energy market.

Banks: Chase and Citi, which do business in Russia, would have to cut ties with local lenders if broad financial sanctions happen. Cross-border payments could be frozen, which might mean lost $$$.

Cars: Dodge and Jeep parent Stellantis says it would limit production in Russia if sanctions disrupt its operations.

Beer: Danish brewer Carlsberg is Ukraine’s biggest beer seller, while Russia accounts for 10% of its sales. It has breweries in both countries and said it’s working on contingency plans in case sanctions disrupt beer-making.

- this is exactly the kind of problem i was highlighting in the Russia thread. These sanctions don't really help us either, but is it the best we can do?Ianbolton

- Nestle have factories in Ukraine.shapesalad

- Just read 90% of semi-conductor grade neon is from Ukraine. That could make the chip problem a lot worse.formed

- Nairn0

If you're a cynical cunt, look into companies that are selling shoulder-mounted missile launchers.

Taiwan's going to be buying fuckloads of them.

- Made a fair few £££ last week with some trades on brent oil.shapesalad

- yes, you keep saying. congrats.Nairn

- Re upped on Raytheon and the War Machine, plus some oil, over a week ago. Been here before.monospaced

- grafician-3

Tomorrow the markets will be messy, stay safe

- pinkfloyd1

Inflation will get worse, gas/oil prices up so everything else will be more expensive.

- grafician-1

^

"*BRENT TOPS $115 AFTER MARKET CLOSE FOR FIRST TIME SINCE 2008"

- sarahfailin0

- woohoo I've got some nickel stock (indonesia and australia) but haven't been looking at my portfolio recently 'cos I was honestly too scared to look lolBuddhaHat

- I have some RIO, those fuckers survive everything.sted

- sell it tomorrow! prices will almost certainly fall just as sharply. also did you know we thought you died? I keep saying this and not getting a response xDsarahfailin

- 68% of world nickel production goes to stainless steel. 17% into other alloys, 9% to plating. Only about 4% is used in batteries.monNom

- But all those things are still important. Try building a refinery or powerplant without stainless steel, or a jet engine without nickel alloys.monNom

- sarahfailin0

Another bad sign for markets is the 50 day moving average crossed bearishly over the 200 day moving average. Sometimes referred to as a "death cross." This happened last in March of 2020 before some real shit went down.

From a WSJ article today regarding the spiking price of oil:

“Not every recession has been caused by an oil price spike but every oil spike has caused a recession,” said Brian O’Reilly, head of market strategy at Mediolanum International Funds. “This is likely to be a drawn-out affair and will have a sustained impact on commodity prices.”

- Yup. Got a full list of crazy low prices set to GTC. Wish I bought more CVX!formed

- sarahfailin0

What I'm interested to see is if meme stocks like Tesla become safe havens of irrationality during this storm, or if they get absolutely hosed and reduced back to sane prices.

The blade of consumer irrationality is usually two-sided. And unless something has fundamentally changed about how markets are picking winner and loser stocks, the meme stocks are about to take a royal shellacking.

- yeah memestocks are slowly bleeding out, services get fckd 100%, rest is running a reality check.

what i don't get is Palantir, what happened therested - PLTR got memed, bro. crashed as hard as it took off. has never posted an annual profit.sarahfailin

- How is Tesla a meme stock?formed

- It's super overvalued, just like gamestop, etc. based on brand popularity not fundamentals.sarahfailin

- yeah memestocks are slowly bleeding out, services get fckd 100%, rest is running a reality check.

- sarahfailin0

Contribution to the 7.5% rise in consumer prices from a year ago, by category and select subcategories

*New and used vehicles accounted for a combined increase of 1.57 percentage points in overall inflation.

** Note: Housing includes rent of primary residence, school housing, hotels, motels and related costs. Figures have been rounded. Source: Bureau of Labor Statisticsreally cool graphic by WSJ on where inflation has happened

- grafician-3

"AMAZON TO SPLIT STOCK 20-FOR-1, BUY BACK UP TO $10B OF SHARES $AMZN"

- CAPS LOCKsted

- sorry, again, it's copy paste, can't be bothered to re-type everytimegrafician

- cmd-k & cmd-l in sublimested

- FINE

next timegrafician - I have a text editor open all the times, and just copy-paste stuff in there to make it look easier to read.sted

- just a suggestion. its simply easier to read text if it isn't in all-caps, not to mention the emotional stress it triggers in some people who take it as yellingsted

- agreed, will take the time and fix it next timegrafician

- This has been quite a discussion about capital letters.CyBrainX

- :)sted

- imbecile0

strange to see the ruble net a 23% gain since saturday

saturday: .0074

tuesday: .0091- Russia’s central bank said that it plans to set a new way to calculate the official exchange rate for the ruble against the dollarsted

- i've read that and see that china is trying to seperate themselves as their economy is being negatively affected as well.imbecile

- value loss is significant on the asian markets too. you won't find too many fans to support these non-stop threats that drags the prices up/down.sted

- grafician-6

"Twitter is expected to reject Elon Musk’s $43 billion bid to buy the company as too low. If that really was his “best and final” offer, as he has said, a tender offer would be his next-best option."

$TWTR will reject the offer and they get back to under $30 for years

prepare your shorts accordingly...

- Everybody knows Twitter is very valuable, but only if somebody provides the cash aka going private

Board is scared they won't see 100x returns typical VC BSgrafician - Either way, Elon has enough stock to veto any future board plans and get it on the cheap next year or sografician

- Let's pray he doesn't. That would be so horrible for this country.formed

- Are you sure? First thing he said he would do getting rid of the bots (or die trying) lolgrafician

- @graf how does he have enough stock to 'veto' anything? They don't vote on every decision the CEO makes.formed

- nevermind formed, he got Twitter straight out tonight :))grafician

- Everybody knows Twitter is very valuable, but only if somebody provides the cash aka going private

- grafician-5

$FB -7% (52wk low)

load up mono

- Sure but in the big picture it’s not super huge, so I can hold off.monospaced

- ;)monospaced

- Die FB! DIE!!formed

- grafician-2

TWTR is at $51 while Elon's offer is at $54

load up mono :))))

- caution.. final offer may work out at $50 a share. Short!shapesalad

- Why are you addressing me?monospaced

- grafician-3

"Twitter's board accepted billionaire Elon Musk's offer to buy the social media company and take it private, the company confirmed."

https://www.cnbc.com/2022/04/25/…

Hahahaha nevermind, I was out for beers while Twitter was going private this evening apparently

don't load up mono ;))))

- grafician-2

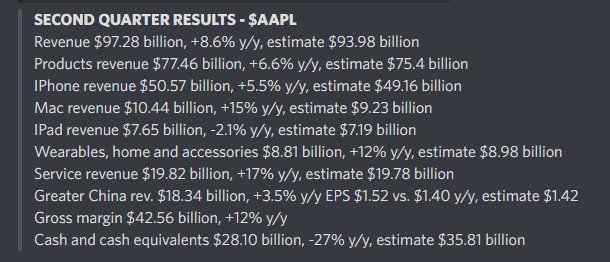

- "*Apple Supply Constraints `Significantly' Lower in Jan-through-March Quarter Than Dec Period -- WSJ"grafician

- Meanwhile "Amazon reports $3.8 bn quarterly loss" hahahahaaaagrafician

- Thankfully they aren’t competitors.monospaced

- LOL ALL FAANG companies are Apple's competitorsgrafician